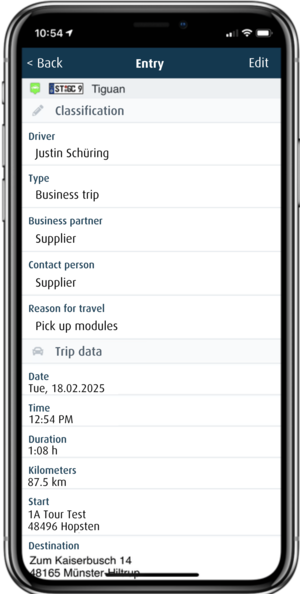

Digital proof for the tax office

The GPS tracking systems from geoCapture include the function of a GPS logbook: this makes keeping logbooks child's play!

Many companies today maintain logbooks. A tedious and time-consuming task that is often forgotten. This leads to considerable problems for the tax office, especially when it comes to the logbook. With an electronic logbook from geoCapture, the time-consuming task of keeping a handwritten logbook is a thing of the past and your tax office will also be pleased.